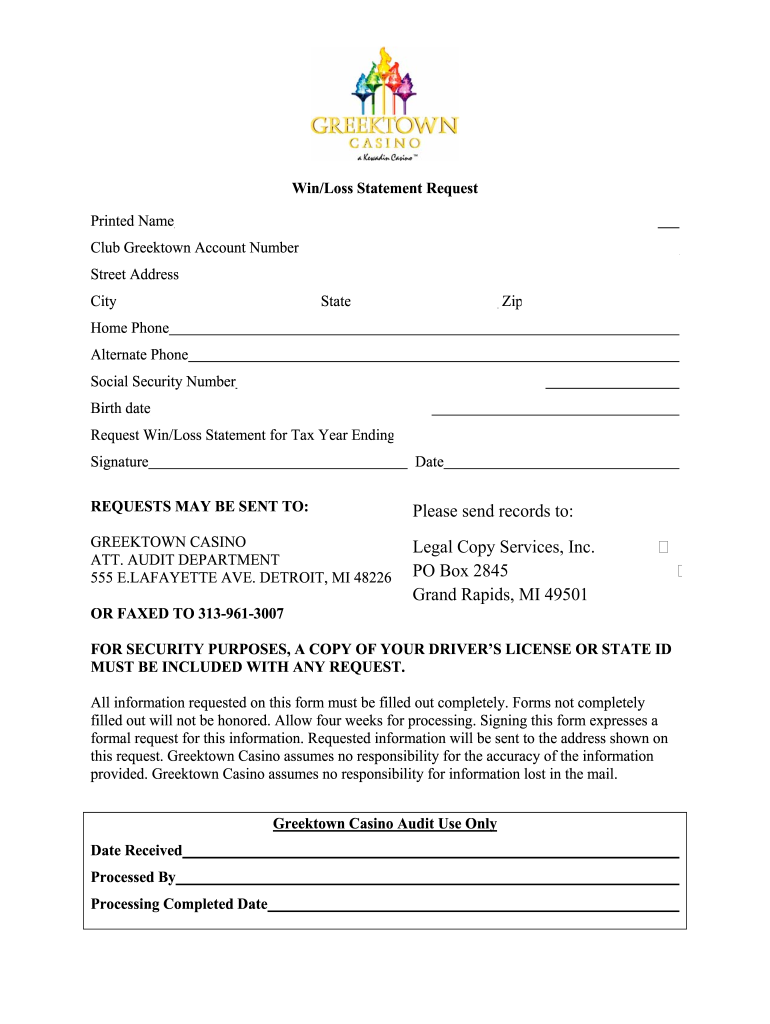

If you would like to receive a year-end win/loss statement for taxes of your gaming activities, please visit our Players Club, open 24 hours a day, and your statement will be provided for you. Need a Win/Loss Statement? Click here to request one. Can I use a casino win/loss statement,to show my losses? Absolutely, just make sure it includes all wins and losses separately and is not a combined number. You should show your gambling winnings as income and then your gambling losses as an itemized deduction, if you qualify. The win/loss statement, or gaming history statement, is an accumulation of slot and table play while using your player’s card for the preceding year. This accumulation includes wins and/or losses while. 2019 Win/Loss Statements I didn’t have one HP last year, so no big wins to offset my losses at Borgata, it’s eye opening. Not even going to check CET, no reason to, only adding salt to my wound.

- Harrah's Win Loss Statement Slot

- Harrah's Win Loss Statement 2019

- Harrah's Win Loss Statements For Taxes

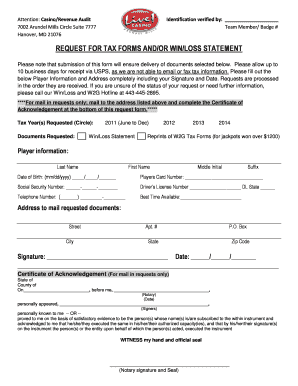

A casino win/loss statement is a report or letter from a casino that summarizes a person’s gambling activity. Typically, such reports total the gambler’s activity by year, activity, and location.

Frequently, the IRS refuses to accept a casino’s win/loss statement as evidence of a gambler’s losses. As an alternative, the IRS recommends that a gambler use a gambling diary or log to record their transactions by gambling session.

In general, many gamblers prefer to use casino win/loss statements because they are easily obtained from the casino. However, what many gamblers don’t realize is that casino win/loss statement can actually cause a gambler to pay more income tax.

Furthermore, the “disclaimer” language which states that that information contained in the casino win/loss statement is not reliable or accurate causes both the IRS and gamblers much consternation, confusion and aggravation.

It is important to remember that casino win/loss statements are not “official” IRS forms like Form W-2G Certain Gambling Winnings or Form 5754 Statement by Person(s) Receiving Gambling Winnings. As a result, the IRS does not regulate the format or time of delivery of casino win/loss statements.

For more specific information regarding a particular casino win/loss statement, please contact the casino or a qualified tax professional.

Harrah's Win Loss Statement Slot

Dear Visitor,

2020 has been a very challenging year, and has hit the gaming industry especially hard. As we move into 2021 we have unfortunately had to make the tough decision to discontinue the Casino Journal brand, including the digital magazine, eNewsletter, and website. We would like to thank all our staff, advertisers and content providers who helped make Casino Journal an industry favorite for many years.

We also want to send a special thank you to our loyal subscribers who have been with us through the years. For our current paid membership subscribers please note that we will be providing refunds for ALL remaining issues on your subscriptions. Please contact our customer service to request a refund.

By telephone at: (800) 952-6643, or if outside the USA: (847) 559-7399

Harrah's Win Loss Statement 2019

By email at: casinojournal@omeda.com .

By mail: PO BOX 2146 Skokie, IL 60076-7844

Harrah's Win Loss Statements For Taxes

Best Regards,

Casino Journal